Cracking the Credit Ratings Code: How Moody’s, S&P, Fitch & DBRS Compare

When evaluating the financial stability of companies or governments, credit ratings play a key role. These ratings are assigned by four major credit rating agencies: Moody’s , Standard & Poor’s (S&P), Fitch, and DBRS. Each agency assesses the ability of a borrower to meet their debt obligations and publishes ratings to reflect that assesment for both long-term and short-term debt.

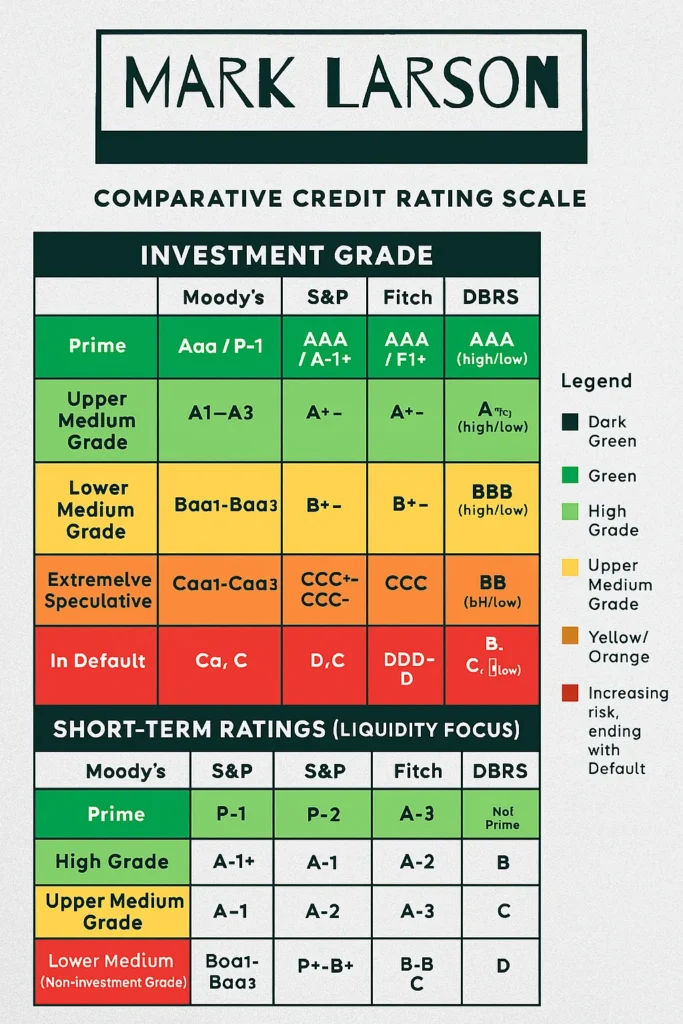

These ratings are generally grouped into categories or “tiers,” ranging from the most reliable known as “Prime” to “In Default” , which indicates a failure to meet obligations. A top-tier rating such as Aaa from Moody’s, AAA from S&P and Fitch, or R-1H from DBRS signals the borrower has a very strong capacity to repay debt.

Beneath the Prime level are other Investment Grade tiers, including High Grade, Upper Medium Grade, and Lower Medium Grade. These categories represent borrowers with solid credit standing and relatively low credit risk.

Anything below Investment Grade falls into Non-Investment Grade, often referred to as “junk” or “speculative” debt. Ratings like Ba (Moody’s) or BB (S&P, Fitch, DBRS) imply higher risk, but also potentially higher returns. As the credit outlook worsens, the ratings descend through Speculative, Substantial Risk, and eventually to Default. The lowest ratings like Ca or C from Moody’s and D from the others indicate serious trouble in repaying debt.

Each agency has its own system:

Moody’s uses a numerical system (e.g., Aa1, Aa2)

S&P and Fitch rely on letter grades with plus/minus signs (e.g., AA+, AA, AA−)

DBRS blends letters with terms like “high” or “low” (e.g., A (high), BBB (low))

Short-term credit ratings, which assess obligations due within a year, also differ across agencies. For example, Moody’s assigns P-1 to its highest short-term rating, while S&P starts with A-1+ and descends from there.

A comparative table often helps visualize how the agencies’ ratings align. These charts, usually color-coded from green (lowest risk) to red (default), are useful tools for investors, risk managers, and financial analysts who want to gauge the relative risk of bonds or other debt instruments.

Updated 02/06/2026