1st Quarter 2026 Industrial Market – Orange County, CA

After nearly three years of contraction, Orange County’s industrial market showed signs of

stabilization in the fourth quarter. Tenant demand turned positive, ending eleven straight

quarters of negative net absorption. While the county still finished the year with overall negative

absorption, the fourth quarter marks an important shift in momentum.

Vacancy increased to 6.7 percent, up from historic lows but still below the national average.

Even with higher vacancy, Orange County remains one of the most desirable industrial markets

in the country, driven by its proximity to the Ports of Los Angeles and Long Beach and access to

a dense consumer base.

Average asking rents declined modestly, ending the quarter at $1.52 per square foot on a triple-

net basis, about 11 percent below the peak in late 2023. Rent pressure was most noticeable in

West County, while South County continued to command the highest average rents.

North County led the recovery this quarter, posting the strongest net absorption and finishing the

year as the only submarket with positive annual growth. The Airport area also saw solid fourth-

quarter demand, though it remained negative for the year overall.

Leasing activity was highlighted by several large transactions, while investment sales remained

selective but active, led by a major acquisition in the City of Orange. New construction

continued to deliver, particularly in South County, adding to near-term supply.

Looking ahead, economists expect slower job growth over the next two years. Inflation, interest

rates, and broader economic uncertainty remain top concerns, but improving tenant demand

suggests the market may be finding its footing.

If you would like a copy of the report, give me a call at 714-564-7109 or email me at

mark.larson@lee-associates.com

2025 Q4 U.S. Commercial Real Estate & Economic Market Report

Economic Overview

The third quarter of 2025 showed a careful sense of hope for the U.S. economic situation, though expectations stayed modest due to ongoing uncertainties. Signs pointed toward growth, yet challenges remained visible across sectors. Even with constant global tensions and high inflation, a number of signs suggested consistent, though slight, progress. Economic output grew by around 1.8%, somewhat slower than last quarter, yet in line with forecasts considering higher interest rates alongside shifts in global supply chains. Meanwhile, the job market stayed resilient, while unemployment remained near 4.2%; wage growth slowed a bit since businesses slowed job growth to control expenses. Meanwhile, price increases eased slightly to a yearly pace of 3.1%, moving slowly closer to the Fed’s goal.

The Fed kept its tight policy unchanged, holding key rates high in order to keep inflation forecasts stable while hinting at lower rates by early 2026. Consumer spending shifted unevenly; personal outlays dipped as borrowing costs rose, though key sectors—including accommodation, medical services, and trips—stayed stable.

Capital Markets

Investment markets during Q3 showed signs of adjustment. Stock indexes performed with muted volatility following an earlier spike during the year; the S&P 500 closed the period higher by 1.3%, lifted by solid results in tech, industry sectors, and health services. Still, valuations stayed under watch while investors re-evaluated growth forecasts given shifting conditions and sustained monetary tightening. Meanwhile, bond markets gained traction because investors looked for steady returns as markets anticipated looser monetary moves. The 10-year Treasury rate held near 4.35%, a bit below Q2’s high point, with yields in commercial mortgage-backed securities widening. CMBS spreads fell slightly, reflecting stronger trust in credit markets.

Commercial Real Estate Performance

The office market continued its structural adjustment phase, with national vacancy rates rising toward 19.1%. Hybrid setups settled near 2.8 office days weekly, influencing what tenants want—smaller areas and better quality. Industrial real estate performance stayed highest in every sector, where vacancies stood at roughly 4.3%; meanwhile, rent increases slowed, now at 5% compared to last year. Meanwhile, retail keeps improving due to outdoor hubs built around supermarkets and bargain stores, alongside apartment complexes. Factors dipped a bit yet stayed high by past standards, hitting 94% usage with a 3.2% yearly rise in rental costs.

Construction and Development Trends

Rising funding prices, alongside higher supply costs, kept holding back fresh construction launches throughout many industries. Overall building work dropped 14% compared to last year; firms with growing numbers chose partnerships or early sales to reduce uncertainty. Flexible reuse and redevelopment initiatives picked up speed, especially converting offices into homes, backed by local authorities’ support. ESG along with environmental responsibility thoughts on efficiency still shaped funding, as backers focused more on eco-friendly solutions while also valuing lower resource use and low-carbon properties.

Regional Market Highlights

The West region, including Los Angeles and Seattle, experienced moderate leasing activity despite ongoing cost challenges. Manufacturing held steady, whereas commercial space slowed down. In the Midwest, gains were seen as Chicago and Minneapolis strengthened in both industrial and retail basics. The South led growth nationally, with Dallas-Fort Worth and Atlanta showing strong population money flows and building activity continued. In the Northeast, New York and Boston held steady, bifurcated; top-tier assets rose faster than aging standard holdings.

Investment and Financing Environment

Lending terms stayed cautious, as mainstream lenders focused on reduced borrowing with improved coverage levels. Meanwhile, private lenders stepped in where markets lacked fluidity; CMBS issuance increased slightly due to better investor sentiment. Meanwhile, cap rates widened by 25–50 basis points; yet strong properties featuring extended leases stayed sought after. Corporate investors continued to dominate acquisitions in core sectors.

Outlook for Q4 2025 and 2026

Economic conditions should improve steadily as inflation slows down; meanwhile, growth may pick up slightly, though risks remain balanced overall. Interest reductions could happen by early 2026. Meanwhile, industrial properties along with multifamily units are likely to remain leading choices, whereas workplaces keep evolving via flexible redesign. Retail will likely shift toward combined spaces focused on services. However, investors remain cautious about timing and may target high-potential regions with underperforming assets instead of relying on stable returns.

Conclusion

The 2025 Q3 Market Report highlights a shifting real estate scene; though despite ongoing economic challenges, core conditions remain stable. However, investor sentiment remains cautious as participants shift tactics to fit steady rates while adapting their approach accordingly to changing demands from tenants. Lee & Associates highlights using data to guide choices moving forward, with local knowledge together with active oversight of resources. With 2026 near, planning ahead with a shifting focus along with eco-minded funding will shape winning markets.

Evaluating Quick-Service Giants: McDonald’s, Taco Bell, and Burger King Through the Lens of Commercial Real Estate

Introduction

For years, fast food places were key to single-tenant net lease investments. The single-tenant net lease world – it’s a pretty straightforward place to put money, bolstered by well-known brands. Sites geared toward quick service – with a focus on drive-throughs – appeal to large investors alongside individuals. Folks putting up money sometimes see big differences between fast food chains – specifically how much return they get. Differences show up in how good the loans are, what the leases look like, and also the property itself.

This report spotlights McDonald’s, Taco Bell, alongside Burger King. The real estate market is ruled by King, yet its value assessments, return rates, alongside costs based on area differ considerably.

McDonald’s

Cap Rates and Pricing

McDonald’s locations sell for the highest prices relative to earnings when compared to similar fast-food chains. This was true going into 2025. By 2025, expect cap rates around 3.96% – though many sales are happening nearer 4.0%. Similar properties have sold for roughly $525 to $675 per square foot; however, a few…

Leasing Land

Leasing land within cities now fetches remarkably better rates.

Building Size and Lease Terms

Typically, McDonald’s restaurants occupy between 3,500 and 4,500 square feet – situated on lots measuring roughly three-quarters to one and a half acres. Land spots boast convenient drive-through access. Agreements usually last two decades – often structured as long-term land leases. A setup where the person using the land – the tenant – holds ownership of anything built on it, yet still owes regular payments for just having the land itself to the actual landowner. It’s a rental situation. Rent hikes aren’t fixed; fresher agreements sometimes include a 10% jump after half a decade, yet others… Initially, previous agreements remain unchanged for ten years.

Credit and Risk Profile

McDonald’s boasts solid financial standing – S&P rates them BBB+, while Moody’s gives a Baa1 score, both indicating reliable creditworthiness. Often, leases come with a company backing them – like a ground lease arrangement – so landlords… Duties won’t overwhelm you. Though ground leases forgo tax advantages like depreciation, boost what remaining property is worth. Alongside solid financial support, this offers a lasting, McDonald’s often costs more because of its real estate deals – specifically, how they lease their land. Typical store prices.

Live Comp Example

A McDonald’s in Middletown, PA was listed on Crexi at a ~4.00% cap with ~3,886 SF. Similar to what’s happening across the country, a separate report by Net Lease Guy indicates roughly 3,919 square feet. Properties are trading near $2.9 million, yielding roughly a 4.06% capitalization rate – which suggests net operating income close to $117,000.

Conclusion on McDonald’s

If you want a safe bet, something unlikely to cause worry, McDonald’s stands out. Evaluating performance reveals a downside – returns are small. They behave similarly to bonds; however, this makes properties particularly appealing to those using 1031 exchanges, likewise investors who focus on… safety.

Taco Bell

Cap Rates and Pricing

Taco Bell lands squarely among fast-food restaurants. Investment returns typically hit around 5.55%, roughly 160 basis points. It yields a bit more than McDonald’s, yet costs more for the space it occupies. Costs shift between $788 and $931. That surprising price – for each square foot – shows the… New fast-food places are getting built smaller, yet cost a fortune to lease – especially those with drive-thru lanes.

Building Size and Lease Terms

Taco Bell restaurants generally occupy between 2,200 to 2,600 square feet, situated on lots ranging from half an acre up to 1.2 acres. They typically lease. Leases generally run for two decades, also offering several chances – at least four – to extend them by another five years. Most leases follow this pattern. Financing relies on promises from franchise owners, not the company itself. Rental costs go up differently each time. Typically, increases happen every five years – often between 5 to 10 percent – though this relies on how well each franchise is doing.

Credit and Risk Profile

Typically, individual Taco Bells operate thanks to franchise agreements. However, Yum! Brands stands behind them. Rated BB+ by S&P alongside a Ba2 from Moody’s – not quite top tier, yet Taco Bell remains a… The concept really shines within Yum! Brands – stores are doing well, so investors feel confident. Back both the name itself alongside how well franchisees are doing, especially those running several locations. Folks tended to trust chains over individual shopkeepers. It felt safer somehow. Consequently, businesses run by larger companies had a reputation for dependability – a feeling independent sellers struggled to match.

Live Comp Example

Net Lease Advisor data shows Taco Bell cap rates holding around 5.5% for new 20-year rental agreements. These properties are frequently priced between $3.2 to $3.5 million. They generally bring in about $180,000 net operating income, which translates to a price per square foot of nearly nine hundred dollars. Mostly brand-new test locations boasting double drive-through lanes, built to… Lots of work gets done quickly.

Conclusion on Taco Bell

Taco Bell delivers more return compared to McDonald’s, yet relies on a familiar idea. People really want these products, yet success hinges on franchisees having good finances. Those wanting to invest should be aware Taco Bell could benefit from investments offering decent returns alongside updated, costly real estate.

Burger King

Cap Rates and Pricing

Compared to the others, Burger King properties are changing hands for the lowest price relative to their income – around 6.38%. Costs run 2.4% more than McDonald’s, meanwhile exceeding Taco Bell’s by 0.8%. Each item… The cost per square foot generally falls between $439–$585, a good deal less than what you’d pay at Taco Bell or… McDonald’s.

Building Size and Lease Terms

Typically, Burger King spots range from 3,000 to 4,000 square feet, sitting on properties that measure between a half acre and up to 1.5 acres. Typically, leases run ten to fifteen years – less time than what Taco Bell or McDonald’s commit to for their land. Rental agreements are a thing. Expect rent hikes – roughly 8 to 10 percent – every half decade.

Credit and Risk Profile

Burger King is owned by Restaurant Brands International (RBI), which carries a BB rating. Originating from ratings below investment quality – think S&P’s lower tiers. Similar to how Taco Bell operates, a majority of Burger King locations aren’t company-owned but leased by franchisees. Assured, yet service depends on who’s running things – some franchise owners really deliver. Strong brands offer security; however, less established locations introduce greater potential for trouble.

Live Comp Example

NetLeaseFinder lists several Burger King NNN properties, typically with 10–15 years of borrowing costs hovering around 6.5%. Net Lease Advisor points out typical property dimensions. Details finalized – the deal confirms a 6.38% return on investment.

Conclusion on Burger King

Burger King offers big potential gains, yet comes with substantial uncertainty. Those comfortable with… Assess how a company’s money situation alongside property values impact profits, considering differences compared to… You might find McDonald’s appealing. Though, for shoppers who prefer sticking to what they know, Burger King could offer more. Didn’t quite hit the safety marks.

Market Backdrop

According to The Boulder Group’s Q2-2025 report, single-tenant net lease cap rates held steady. Generally, we saw a 6.79% rate; stores clocked in at 6.57%, barely a nudge higher – just one basis point. The numbers held steady from one three-month period to the next. Consequently, interest rates didn’t jump around much. The rapid growth seen from 2022 through 2023 has slowed.

Considering everything happening around us: McDonald’s stock, currently at 3.96%, is a bargain compared to typical rates – a pretty secure bet, really. Taco Bell, with a 5.55% rate, seems to be moving toward typical customer levels – however, it remains more focused than most restaurants folks sharing a meal together. Burger King’s 6.38% rate is a touch under what most stores charge, suggesting their prices take that into account. Despite some franchise challenges, quick-service restaurants generally hold steady.

Drivers of the Spread

Credit and Lease Structure

McDonald’s properties boast solid financial backing – think top ratings, commitments from the company itself, yet often involve long-term land agreements. Taco Bell alongside Burger King: Mostly, franchisees back these deals. How much income you get from them changes a lot based on… How well things run, how much stuff sells, whether the money coming in beats the costs – that’s what matters.

Unit Economics and Real Estate

Drive-thru designs now being tested, along with spots on corners or within existing city areas, require more careful size limits. Less reliable companies, aging properties, also trading on secondary exchanges – these factors contribute to larger discrepancies in assessed value. Taco Bell’s newer locations frequently cost more to lease, despite… Even so, they charge more than McDonald’s.

Lease Terms and Escalations

Extended lease lengths, alongside rent increases, offer investors greater security. Think McDonald’s or Taco Bell agreements. Typically, a restaurant sticks around for two decades. However, Burger King spots often have leases lasting just ten to fifteen years.

Key Takeaways

McDonald’s locations offer strong financial standing – good credit, leases where the tenant handles most property responsibilities – but returns aren’t huge, hovering around 4%. A place where traditional shoppers feel secure. Taco Bell delivers decent returns – around 5.5% – operates newer, expensive locations, boasts a solid brand idea. Strong results tempered by dependence on the financial health of franchise owners. Burger King offers potentially bigger returns – around 6 to 6.5 percent – however, investing comes with greater uncertainty because many restaurant owners aren’t considered top-tier financially. Offers assurances, flexible leases, also a range of service providers.

Building a Comp Set

Folks looking at quick-service restaurant investments need to: Gather current property details directly from Crexi, LoopNet, NetLeaseFinder, likewise Ten-X. To find what properties recently sold, tap into services such as CoStar or CompStak. Adjust comparable properties to reflect similar lease terms, rent increases, moreover tenant allowances. Explore how property values shift when rental income or investment return rates change; create charts showing these possibilities. Good comparisons feature top examples – like recent McDonald’s land deals yielding 4%. Comparable stores – like a Taco Bell seeing 5.5% growth – contrast with underperforming ones, such as some aging Burger King locations 6.75%+).

Conclusion

A look at quick service restaurants leased to one owner reveals that a strong name, solid finances, along with… How a lease is set up affects what investors will pay. People still look to McDonald’s as solid, while Taco Bell strikes a chord offering sensible returns alongside up-to-date spaces, while Burger King gets the job done. Greater returns come with greater chances of loss. Considering current single-tenant net lease retail rates hover around 6.6%, these charts show where people put their money depending on how comfortable they are with losing it, also considering… What people earn versus what they require to live.

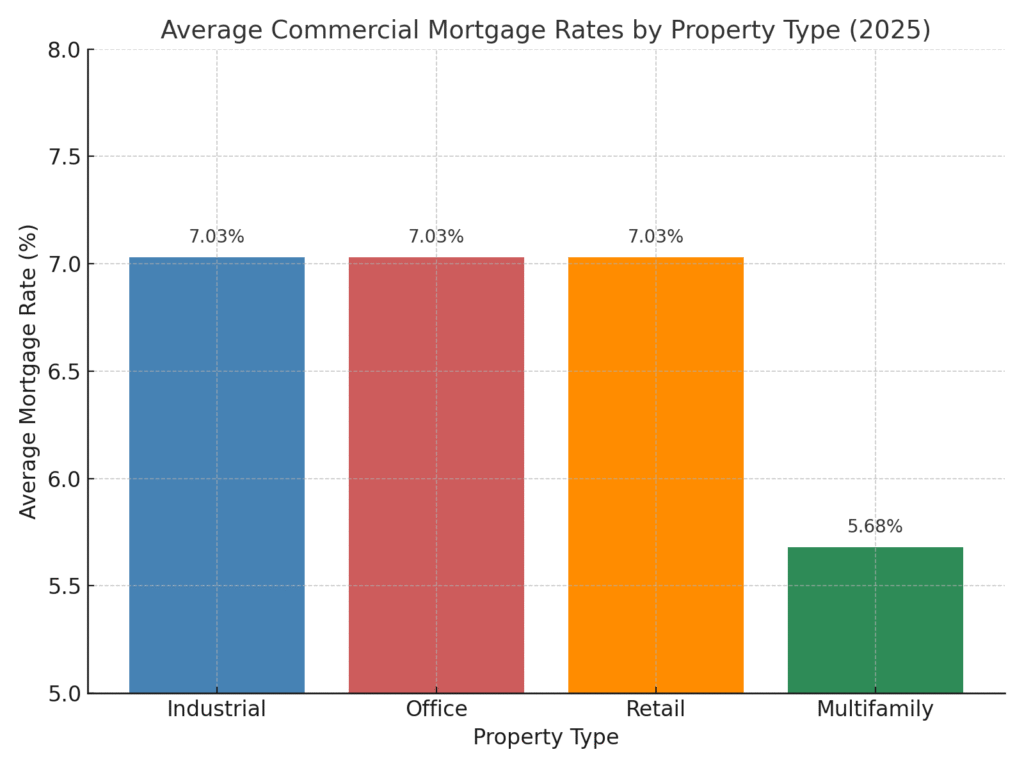

Negative Leverage Trends in Commercial Real Estate

By mid 2025, the commercial real estate (CRE) market is still feeling the weight of higher base interest rates, which have pushed up borrowing costs across nearly every asset class. Whats notable is that capitalization rates haven’t moved upward at the same pace. The result is a shrinking spread between cap rates and interest rates; most evident in the multifamily and industrial segments, two areas that traditionally show strong fundamentals. This tightening has led to more frequent cases of “negative leverage,” where the cost of debt exceeds the return on the asset.

In these conditions, investors lean more heavily on property performance and net operating income (NOI) growth to justify acquisitions, hoping spreads eventually normalize. The challenge is that inflationary pressures remain stubborn, and the market has largely accepted the idea of a “higher-for-longer” rate environment. Unless there are meaningful macroeconomic changes , spreads are unlikely to shift quickly.

Still, data through April 2025 shows the trend may be easing. The share of transactions marked by negative leverage has begun to taper off, hinting at either reduced investor appetite or adjusted pricing expectations. Supporting this , cap rate and interest-rate spread figures show early signs of stabilizing.

Market sentiment has also shifted with expectations for monetary policy. As of June 2025, CME Group data reflects a 65% chance of at least two rate cuts before year-end, a view fueled by weaker GDP forecasts and adjustments in trade policy. If those cuts arrive, they could relieve some of the pressure by lowering financing costs and widening spreads back toward healthier levels.

In short, negative leverage remains a headwind, but there are indications the market is finding its footing. Should monetary easing take place later in 2025, it could mark the start of a more balanced relationship between borrowing and investment returns.

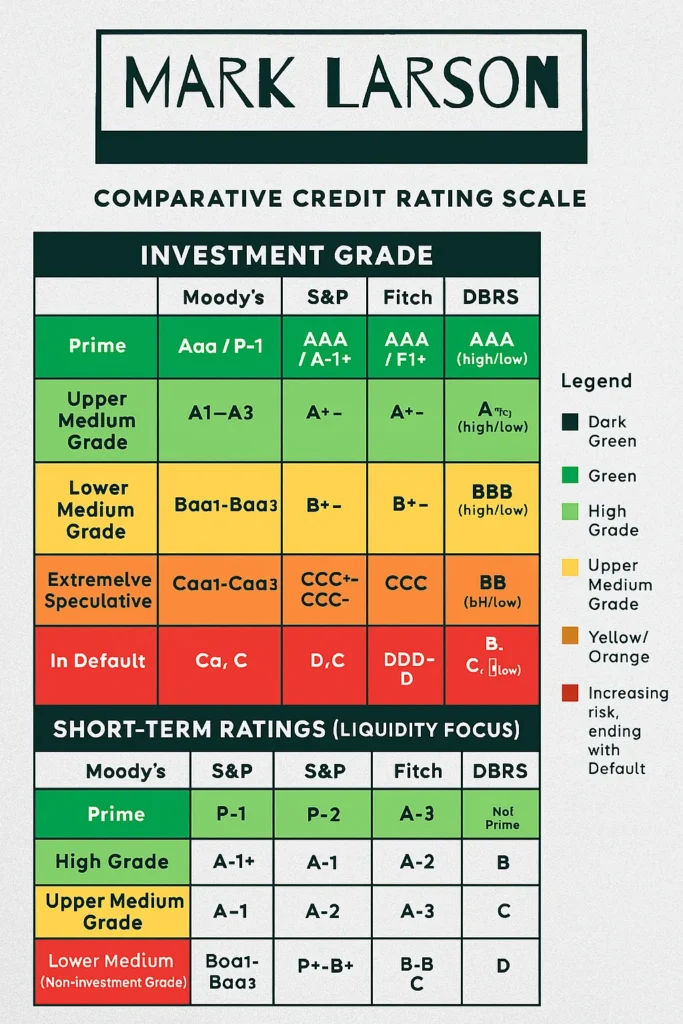

Cracking the Credit Ratings Code: How Moody’s, S&P, Fitch & DBRS Compare

When evaluating the financial stability of companies or governments, credit ratings play a key role. These ratings are assigned by four major credit rating agencies: Moody’s , Standard & Poor’s (S&P), Fitch, and DBRS. Each agency assesses the ability of a borrower to meet their debt obligations and publishes ratings to reflect that assesment for both long-term and short-term debt.

These ratings are generally grouped into categories or “tiers,” ranging from the most reliable known as “Prime” to “In Default” , which indicates a failure to meet obligations. A top-tier rating such as Aaa from Moody’s, AAA from S&P and Fitch, or R-1H from DBRS signals the borrower has a very strong capacity to repay debt.

Beneath the Prime level are other Investment Grade tiers, including High Grade, Upper Medium Grade, and Lower Medium Grade. These categories represent borrowers with solid credit standing and relatively low credit risk.

Anything below Investment Grade falls into Non-Investment Grade, often referred to as “junk” or “speculative” debt. Ratings like Ba (Moody’s) or BB (S&P, Fitch, DBRS) imply higher risk, but also potentially higher returns. As the credit outlook worsens, the ratings descend through Speculative, Substantial Risk, and eventually to Default. The lowest ratings like Ca or C from Moody’s and D from the others indicate serious trouble in repaying debt.

Each agency has its own system:

Moody’s uses a numerical system (e.g., Aa1, Aa2)

S&P and Fitch rely on letter grades with plus/minus signs (e.g., AA+, AA, AA−)

DBRS blends letters with terms like “high” or “low” (e.g., A (high), BBB (low))

Short-term credit ratings, which assess obligations due within a year, also differ across agencies. For example, Moody’s assigns P-1 to its highest short-term rating, while S&P starts with A-1+ and descends from there.

A comparative table often helps visualize how the agencies’ ratings align. These charts, usually color-coded from green (lowest risk) to red (default), are useful tools for investors, risk managers, and financial analysts who want to gauge the relative risk of bonds or other debt instruments.

Updated 02/06/2026

What the Lee & Associates Brokers See – 2025 Industrial Market Pulse

Overview

The 2025 Industrial Market Pulse report encapsulates the perspectives of 118 industrial real estate brokers from 47 Lee & Associates offices across the U.S. and Canada. The survey, conducted in May 2025, explores brokers’ outlooks on industrial market trends, tenant behavior, leasing activity, and shifting space requirements. Overall, it portrays a cautiously optimistic yet tenant-driven market environment.

General Market Sentiment

The brokers’ sentiment can be described as “cautiously optimistic.” While economic and political uncertainty ,particularly tariff-related issues, has prompted some tenants to pause major decisions, most brokers still expect stable market performance over the next 6–12 months. A key theme throughout the findings is cost sensitivity, with tenants pushing back against rising lease expenses and expecting more concessions from landlords.

The tenant sentiment, as captured in the report, is cautious and steady. Tenants are generally risk-averse, opting to delay decisions amid uncertainties. This translates into heightened pressure on landlords to remain flexible and competitive.

Leasing and Tenant Trends

One of the most critical takeaways is that the industrial leasing landscape has shifted decisively toward tenants. The size of the space significantly affects market leverage. Tenants with requirements in certain size ranges are encountering more options, enabling them to negotiate for lower rents, improved concessions, and shorter lease terms .

The survey highlights five key shifts in tenant behavior:

- 58.5% of brokers observed a greater sensitivity to rental rates and operating expenses.

- 48.3% reported that tenants now expect more generous tenant improvement (TI) packages and concessions.

- 46.7% noted downsizing and demand for smaller footprints.

- 44.1 % indicated a preference for shorter lease durations

- 24.6% observed increased interest in second-generation or Class B/C spaces at discounted rates.

Lease Rate Outlook

Expectations for lease rate movements are mixed but conservative:

- 34.5% of respondents foresee an increase.

- 31.9% believe rates will stay flat

- 26.7% predict a decline.

- 6.9% consider the market too unpredictable to forecast accurately.

This distribution reinforces the broader narrative of minimal growth or stagnation in lease rates, reflecting the broader caution pervading the market.

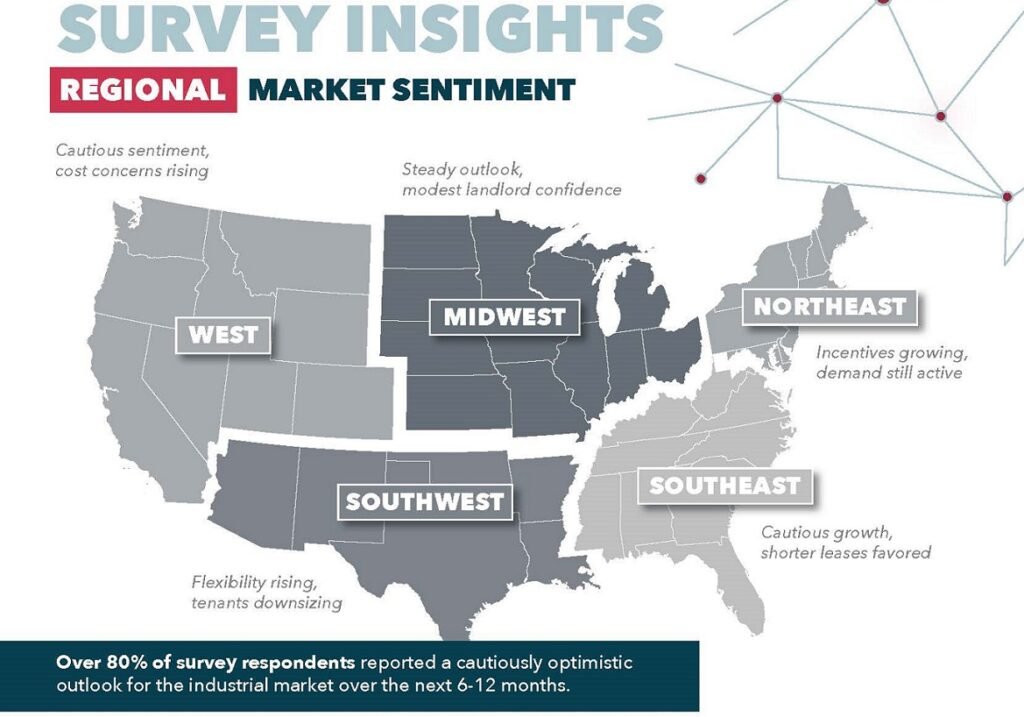

Regional Insights

The report also breaks down sentiment by region:

- West: Demand persists, but cost concerns are rising.

- Southwest: Tenants are downsizing, and flexibility is more valued.

- Midwest: Shows a steady outlook with modest confidence among landlords.

- Southeast: Cautious growth with a preference for shorter leases.

- Northeast: Incentives are increasing to keep up with active demand.

These regional nuances highlight localized dynamics but maintain the overarching themes of tenant leverage and landlord concession.

Conclusion

The 2025 Industrial Market Pulse underscores a market navigating cautious optimism tempered by economic uncertainties and tenant-driven dynamics. While brokers remain hopeful about the coming months, they are keenly aware of shifts in power dynamics favoring tenants; prompting landlords to adapt through pricing flexibility, shorter lease structures, and added incentives. This report is not only a snapshot of present conditions but also a guide to navigating the evolving industrial real estate landscape.

Top Emerging Opportunities in Orange County Commercial Real Estate Sector

Top Emerging Opportunities in Orange County’s Commercial Real Estate Sector

Orange County’s commercial real estate sector continues to evolve, offering investors and businesses new opportunities across various asset classes. From the rise of mixed-use developments to the growing demand for industrial space, several trends are shaping the market. Here are some of the most promising emerging opportunities in Orange County’s commercial real estate sector, backed by real examples.

1. Mixed-Use Developments Driving Growth

Mixed-use developments, which integrate residential, retail, and office spaces, are becoming increasingly popular. These projects create vibrant, walkable environments that appeal to both businesses and residents.

Example: The Irvine Spectrum District has continued to expand, blending luxury apartments, office spaces, and retail shops. Companies are attracted to the convenience of having workspaces near amenities, while residents enjoy easy access to dining and entertainment options.

2. Industrial Space Boom Due to E-Commerce

The industrial real estate market in Orange County is seeing a surge in demand, driven by e-commerce and logistics companies needing distribution and fulfillment centers.

Example: Amazon’s Fulfillment Center in Santa Ana has contributed to the region’s industrial growth, increasing demand for warehouse and distribution spaces in nearby cities like Anaheim and Fullerton. This has resulted in rising lease rates and new industrial developments.

3. Life Sciences & Medical Office Expansion

The demand for healthcare-related real estate, including medical office buildings and life sciences campuses, is increasing as Orange County solidifies its role as a hub for biotech and healthcare innovation.

Example: The University Lab Partners Incubator in Irvine provides state-of-the-art lab space for biotech startups, fueling growth in life sciences real estate. Additionally, Hoag Hospital’s ongoing expansions in Newport Beach and Irvine signal continued demand for medical office buildings.

4. Redevelopment of Aging Retail Centers

As consumer preferences shift, older retail centers are being redeveloped into mixed-use spaces or entertainment destinations to attract more foot traffic.

Example: MainPlace Mall in Santa Ana is undergoing a major transformation, with plans to add residential units, modernized retail spaces, and experiential dining options. This shift is revitalizing the area and drawing new investment interest.

5. Demand for Flexible & Co-Working Spaces

With the rise of hybrid work models, flexible office spaces and co-working environments are in high demand, especially in business hubs like Irvine and Costa Mesa.

Example: WeWork’s Expansion in Costa Mesa reflects the increasing demand for flexible office space solutions that cater to startups, freelancers, and remote teams.

Looking Ahead

Orange County’s commercial real estate market presents numerous investment and development opportunities. Whether it’s capitalizing on the industrial boom, tapping into the life sciences sector, or redeveloping outdated properties, strategic investors and businesses can benefit from these emerging trends. Staying ahead of market shifts and understanding localized growth areas will be key to success in this evolving landscape.

For expert insights and investment guidance, reach out to Mark Larson, a trusted commercial real estate broker with deep knowledge of the Orange County market.

Investing in Commercial Real Estate in Fullerton, CA: Why Now Is a Smart Move

Investing in Commercial Real Estate in Fullerton, CA: Why Now Is a Smart Move

If you’ve been considering expanding your investment portfolio, commercial real estate in Fullerton, California presents a compelling opportunity. From retail spaces to mixed-use developments, this dynamic Orange County city offers strong fundamentals for long-term growth and immediate returns.

Why Fullerton?

Located in northern Orange County, Fullerton is more than just a college town. With a population of over 140,000 and home to institutions like California State University, Fullerton (CSUF), the city enjoys a constant flow of traffic, business, and cultural activity.

1. Strong Economic Growth

Fullerton boasts a diversified economy with a healthy mix of education, healthcare, manufacturing, and retail. This economic diversity provides stability for commercial tenants — a key factor for real estate investors.

- Job growth is steady

- Low commercial vacancy rates

- Ongoing city development projects

2. Demand for Retail and Office Space

The revitalization of Downtown Fullerton has sparked demand for retail and mixed-use space. Trendy restaurants, coffee shops, and boutiques attract locals and students alike.

At the same time, flexible office spaces are increasingly attractive to startups and small businesses seeking proximity to Los Angeles without LA prices.

3. Development-Friendly Zoning

The City of Fullerton offers investor-friendly zoning policies, particularly in transit-oriented and mixed-use areas. These allow for adaptive reuse, vertical development, and increased density — ideal for modern investors looking for value-add opportunities.

4. Long-Term Value & Appreciation

Orange County continues to be one of the most competitive markets in Southern California. Fullerton’s affordable entry point relative to nearby cities makes it a strategic location for long-term appreciation.

What Investors Are Saying

“I’ve helped several clients acquire multi-tenant buildings in Fullerton over the past 2 years,” says Mark Larson, local real estate advisor. “With strong tenant retention and city support for commercial development, the ROI potential here is impressive.”

5. Opportunities in Underutilized Properties

Many older properties in Fullerton are ripe for renovation, repurposing, or redevelopment. Investors willing to modernize buildings or convert space can unlock significant equity and rental income potential.

Available Hotspots for Investment

- Retail / Restaurant in Downtown Fullerton – Foot traffic, nightlife, mixed-use buildings – Link -> Freestanding ±3,369 SF retail/restaurant building for sale in Downtown Fullerton – marklarsoncre.com

- Three buildings with strong tenants, parking, and excellent visibility.– Commercial and office zoning – Link -> Industrial/flex property for sale in Fullerton, CA. ±38,646 SF across three buildings with strong tenants, parking, and excellent visibility. – marklarsoncre.com

- Apartment Homes in Fullerton California – SOLD -> Link -> Las Palmas Apartment Homes in Fullerton California – marklarsoncre.com

Final Thoughts

Whether you’re a seasoned investor or exploring your first commercial property, Fullerton offers the perfect mix of stability, growth potential, and community support. If you’re ready to take the next step, reach out today — I’d be happy to show you available listings and opportunities tailored to your goals.

The State of Commercial Real Estate in Orange County: Market Trends & Insights

The State of Commercial Real Estate in Orange County: Market Trends & Insights

Orange County’s commercial real estate market continues to be a dynamic and evolving landscape, shaped by economic trends, shifting business demands, and investor confidence. As a premier location for businesses and commercial investors, Orange County offers unique opportunities across various sectors, including office space, industrial properties, and retail developments.

Current Market Trends

1. Office Space Recovery and Adaptation

The office sector in Orange County has faced significant changes in recent years due to hybrid work models and evolving corporate needs. While demand for traditional office spaces has softened, there is a noticeable shift toward flexible, high-quality work environments that emphasize collaboration and amenities. Areas like Irvine and Newport Beach continue to attract companies looking for premium office spaces with modern layouts and convenient access to transit hubs.

2. Industrial Boom Continues

Industrial real estate remains a hot commodity in Orange County, with high demand from e-commerce, logistics, and manufacturing sectors. The rise of online shopping has fueled the need for distribution centers and warehouse space, driving vacancy rates to record lows. Cities such as Anaheim, Santa Ana, and Costa Mesa have seen a surge in industrial developments, with rental rates climbing steadily due to limited supply.

3. Retail Resilience and Transformation

Despite economic uncertainties, retail real estate in Orange County has shown resilience, particularly in high-traffic and affluent areas. The shift toward experiential retail—such as dining, entertainment, and boutique shopping—has helped brick-and-mortar businesses stay competitive. Popular destinations like South Coast Plaza and Fashion Island continue to draw both local consumers and tourists, ensuring strong leasing activity in premium retail spaces.

Investment Insights

1. High Demand for Mixed-Use Developments

Investors are increasingly looking at mixed-use developments that blend residential, commercial, and entertainment spaces. These projects cater to the growing demand for walkable, live-work-play environments, making them attractive options for developers and investors alike.

2. Rising Interest Rates and Their Impact

With fluctuating interest rates, commercial real estate financing has become more complex. Investors are navigating these changes by seeking creative financing solutions, focusing on value-add properties, and adapting to shifting market conditions.

3. Emerging Submarkets to Watch

While established areas like Irvine and Newport Beach remain prime investment locations, emerging submarkets such as Tustin, Costa Mesa, and Huntington Beach are drawing increased attention. These areas offer lower entry costs while still benefiting from Orange County’s strong economic foundation.

Looking Ahead

As Orange County’s commercial real estate market evolves, staying ahead of trends and understanding key investment strategies will be crucial for success. Whether you are an investor, business owner, or developer, the right market insights can help you navigate opportunities and make informed decisions.

For expert guidance in Orange County’s commercial real estate landscape, reach out to Mark Larson, a seasoned broker with deep market expertise and a commitment to helping clients achieve their real estate goals.