Commercial Real Estate News

Commercial Real Estate News

Overview

The 2025 Industrial Market Pulse report encapsulates the perspectives of 118 industrial real estate brokers from 47 Lee & Associates offices across the U.S. and Canada. The survey, conducted in May 2025, explores brokers’ outlooks on industrial market trends, tenant behavior, leasing activity, and shifting space requirements. Overall, it portrays a cautiously optimistic yet tenant-driven market environment.

General Market Sentiment

The brokers’ sentiment can be described as “cautiously optimistic.” While economic and political uncertainty ,particularly tariff-related issues, has prompted some tenants to pause major decisions, most brokers still expect stable market performance over the next 6–12 months. A key theme throughout the findings is cost sensitivity, with tenants pushing back against rising lease expenses and expecting more concessions from landlords.

The tenant sentiment, as captured in the report, is cautious and steady. Tenants are generally risk-averse, opting to delay decisions amid uncertainties. This translates into heightened pressure on landlords to remain flexible and competitive.

Leasing and Tenant Trends

One of the most critical takeaways is that the industrial leasing landscape has shifted decisively toward tenants. The size of the space significantly affects market leverage. Tenants with requirements in certain size ranges are encountering more options, enabling them to negotiate for lower rents, improved concessions, and shorter lease terms .

The survey highlights five key shifts in tenant behavior:

- 58.5% of brokers observed a greater sensitivity to rental rates and operating expenses.

- 48.3% reported that tenants now expect more generous tenant improvement (TI) packages and concessions.

- 46.7% noted downsizing and demand for smaller footprints.

- 44.1 % indicated a preference for shorter lease durations

- 24.6% observed increased interest in second-generation or Class B/C spaces at discounted rates.

Lease Rate Outlook

Expectations for lease rate movements are mixed but conservative:

- 34.5% of respondents foresee an increase.

- 31.9% believe rates will stay flat

- 26.7% predict a decline.

- 6.9% consider the market too unpredictable to forecast accurately.

This distribution reinforces the broader narrative of minimal growth or stagnation in lease rates, reflecting the broader caution pervading the market.

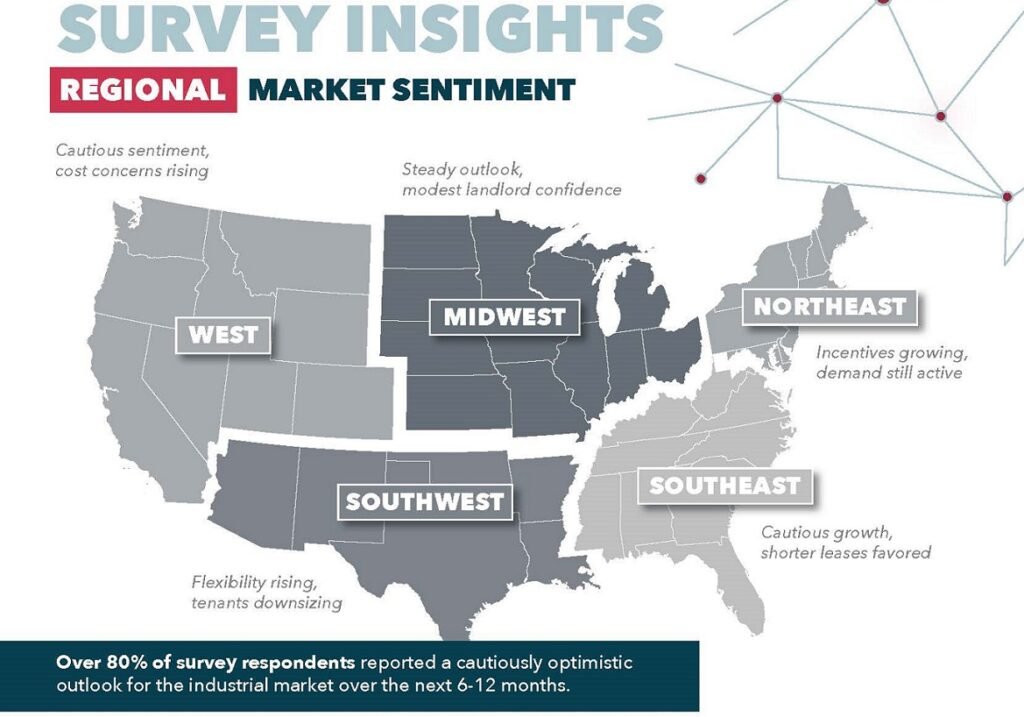

Regional Insights

The report also breaks down sentiment by region:

- West: Demand persists, but cost concerns are rising.

- Southwest: Tenants are downsizing, and flexibility is more valued.

- Midwest: Shows a steady outlook with modest confidence among landlords.

- Southeast: Cautious growth with a preference for shorter leases.

- Northeast: Incentives are increasing to keep up with active demand.

These regional nuances highlight localized dynamics but maintain the overarching themes of tenant leverage and landlord concession.

Conclusion

The 2025 Industrial Market Pulse underscores a market navigating cautious optimism tempered by economic uncertainties and tenant-driven dynamics. While brokers remain hopeful about the coming months, they are keenly aware of shifts in power dynamics favoring tenants; prompting landlords to adapt through pricing flexibility, shorter lease structures, and added incentives. This report is not only a snapshot of present conditions but also a guide to navigating the evolving industrial real estate landscape.