Commercial Real Estate News

Commercial Real Estate News

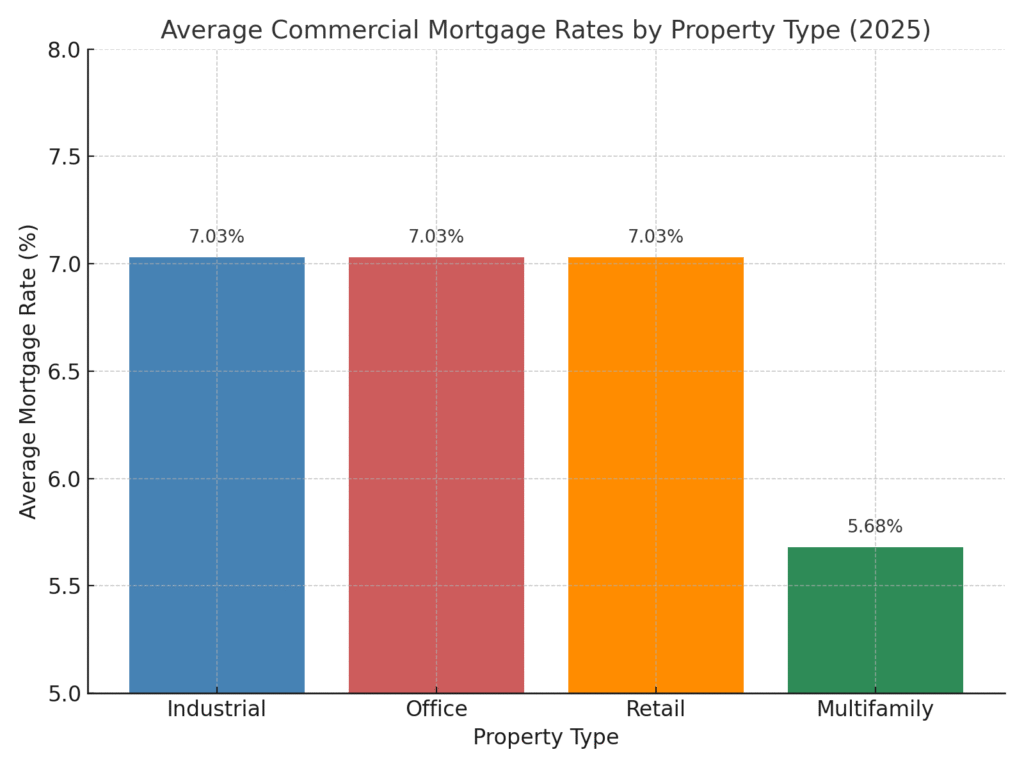

By mid 2025, the commercial real estate (CRE) market is still feeling the weight of higher base interest rates, which have pushed up borrowing costs across nearly every asset class. Whats notable is that capitalization rates haven’t moved upward at the same pace. The result is a shrinking spread between cap rates and interest rates; most evident in the multifamily and industrial segments, two areas that traditionally show strong fundamentals. This tightening has led to more frequent cases of “negative leverage,” where the cost of debt exceeds the return on the asset.

In these conditions, investors lean more heavily on property performance and net operating income (NOI) growth to justify acquisitions, hoping spreads eventually normalize. The challenge is that inflationary pressures remain stubborn, and the market has largely accepted the idea of a “higher-for-longer” rate environment. Unless there are meaningful macroeconomic changes , spreads are unlikely to shift quickly.

Still, data through April 2025 shows the trend may be easing. The share of transactions marked by negative leverage has begun to taper off, hinting at either reduced investor appetite or adjusted pricing expectations. Supporting this , cap rate and interest-rate spread figures show early signs of stabilizing.

Market sentiment has also shifted with expectations for monetary policy. As of June 2025, CME Group data reflects a 65% chance of at least two rate cuts before year-end, a view fueled by weaker GDP forecasts and adjustments in trade policy. If those cuts arrive, they could relieve some of the pressure by lowering financing costs and widening spreads back toward healthier levels.

In short, negative leverage remains a headwind, but there are indications the market is finding its footing. Should monetary easing take place later in 2025, it could mark the start of a more balanced relationship between borrowing and investment returns.